Corporate Tax Return Filing in UAE

Corporate tax (CT) is a tax that the government imposes on the profits of businesses. The UAE announced in January 2022 that it would introduce federal corporate tax (CT) on the profits of businesses, and it officially began on June 1, 2023. The tax rate is 9%, but if a company makes less than AED 375,000 in profits each year, they don't have to pay. Every company has to register for corporate tax and get a Tax Registration Number. Even some exempt companies might have to register too. It will apply to businesses across all the emirates.

What is Corporate Tax (CT)?

Corporate tax is a type of tax that companies have to pay on their profits. It's governed by specific laws, like Federal Decree-Law No.60 of 2023. Companies will start paying corporate tax from the beginning of their first financial year starting on or after June 1, 2023. By introducing corporate tax The UAE wants to achieve several goals which include ,

- Become a top global destination for business and investment.

- Speed up its development and reach its goals faster.

- Show its commitment to international tax standards and prevent unfair tax practices.

Corporate tax in the UAE will apply to all businesses and individuals who have a commercial license to operate in the UAE. This includes both local and foreign companies. Free zone businesses will also be affected, but those that follow all the rules and do not set up in the UAE's mainland will continue to have some benefits. Foreign companies and individuals who regularly do business in the UAE will also have to pay this tax. This includes banks and businesses in real estate, construction, development, agency, and brokerage.

Who Needs to File Corporate Tax Returns?

- Corporations and Companies: In this category come any corporation incorporated under the laws of any country-an example being the C-corporation or S-corporation depending on the specific tax system in that country. All incorporated businesses must file corporate tax returns regardless of company size or revenues.

- LLCs: Some LLCs are taxed as the type of state in which they were formed; it could be a corporation or a partnership. In some cases, this is even taxed individually, depending on the jurisdiction's requirements. In cases where an LLC is treated as a corporation, it files corporate returns.

- Partnerships: Corporate tax is not paid by the partnerships themselves, but tax informational returns are filed reporting income, expenses, and profit distributions to partners, which becomes part of the individual tax returns of those partners. In some countries, however, corporate-formed partnerships file corporate tax returns.

- Non-Profit Organizations: Although some nonprofits are exempt from federal income tax, they may have to submit an annual information return or special tax forms to maintain their tax-exempt status. Failure to file usually leads to the loss of these statuses.

- Foreign Corporations with Source Income: Any foreign entity that operates from any country and hence earns and generates income within that particular country may be subjected to the mandatory filing of corporate tax returns. This requirement varies from country to country and usually depends on the revenues generated within the country.

- Trusts and Estates Business Income: In several jurisdictions, trusts and estates that generate business or hold income-producing assets must submit tax returns subject to certain income thresholds.

- Corporate tax exemptions: various industries or sectors are partially or fully exempted. For example, entities sitting in free trade zones enjoy corporate tax exemptions although submission of returns is still required for compliance and regulatory purposes.

The particular filing requirements tend to depend on the country's tax laws as well as the kind of business. Every entity first should scrutinize the local tax laws and consult with a tax professional to determine specific filing obligations.

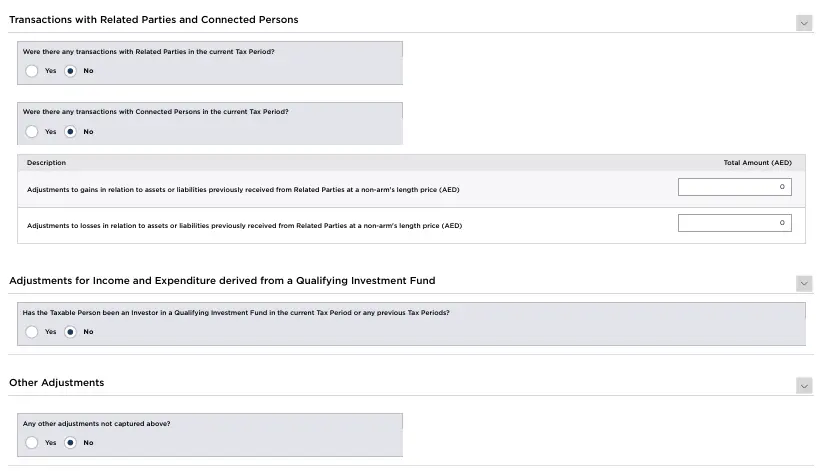

Corporate Tax Filing Form

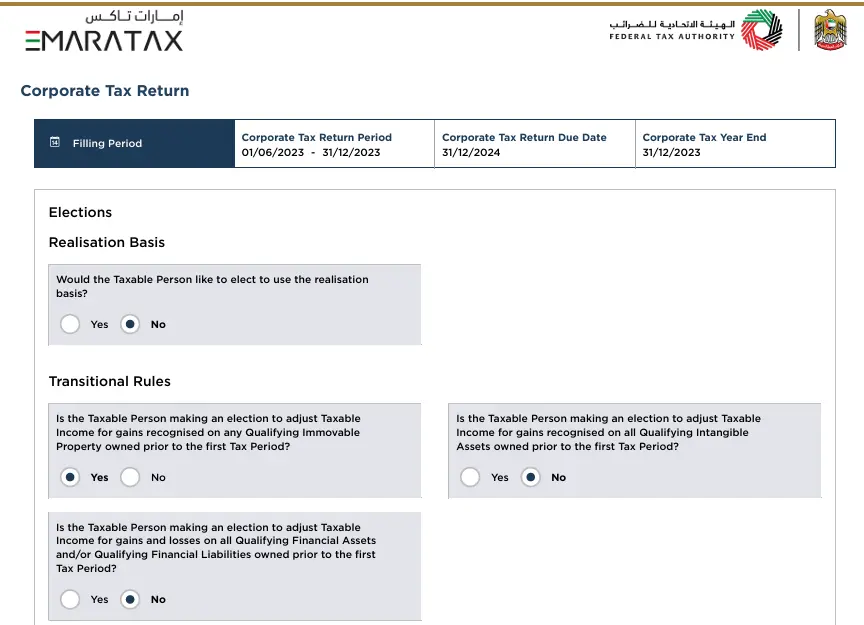

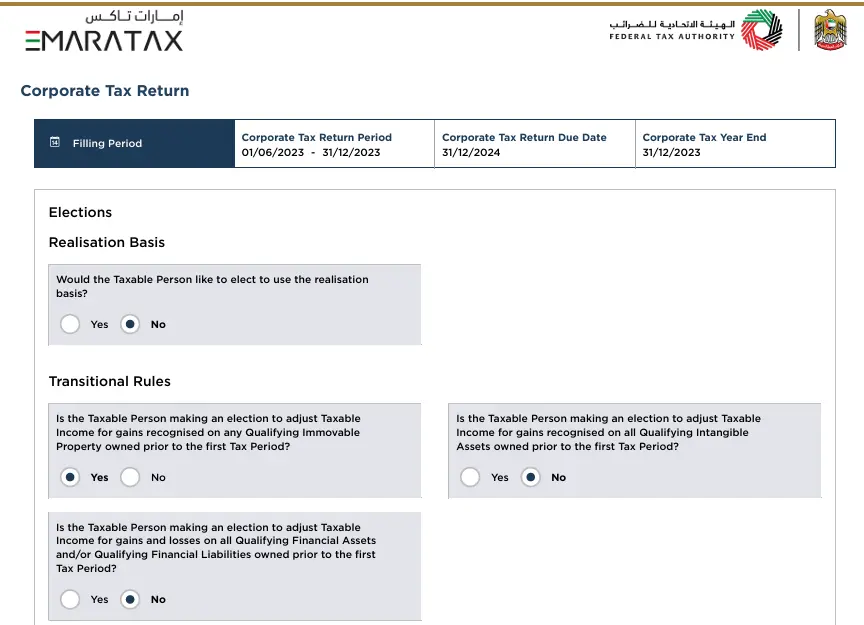

Realisation Basis and Transational Rules

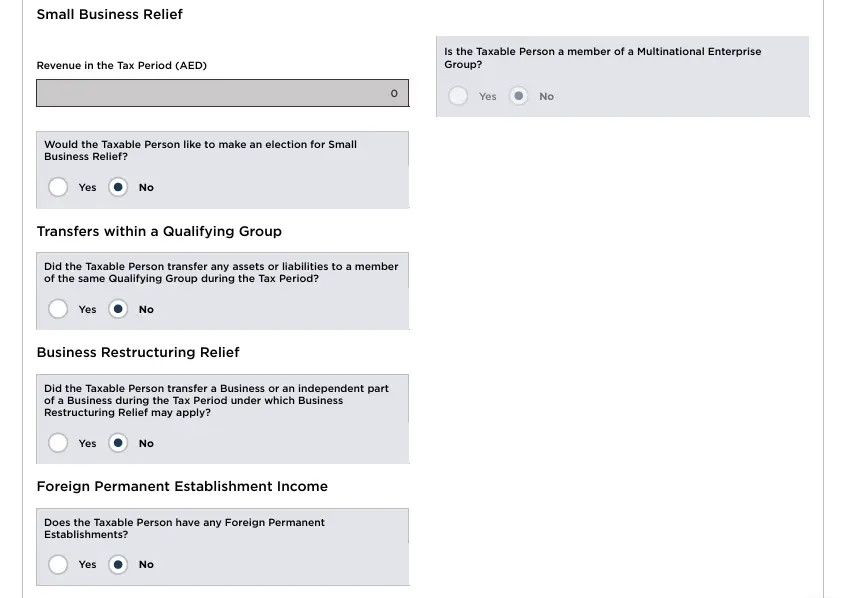

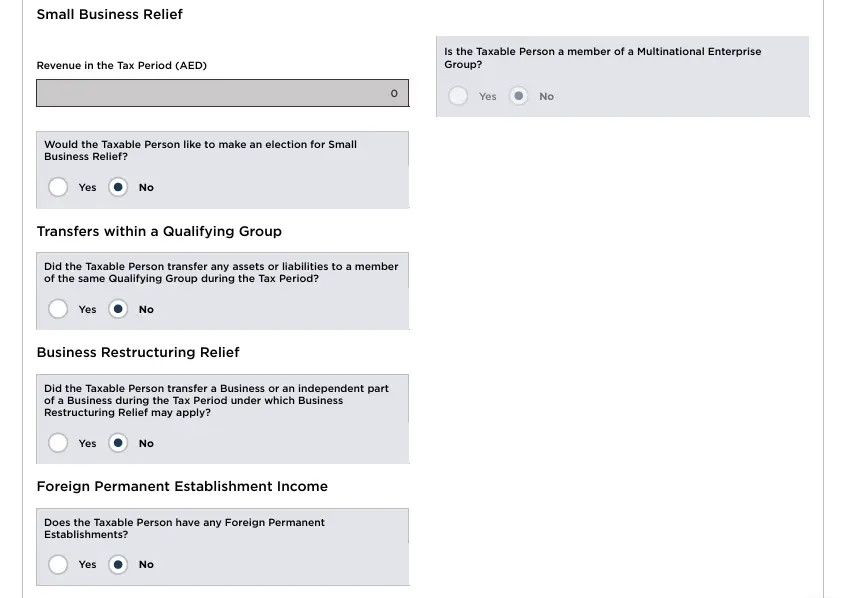

Small Business Relief

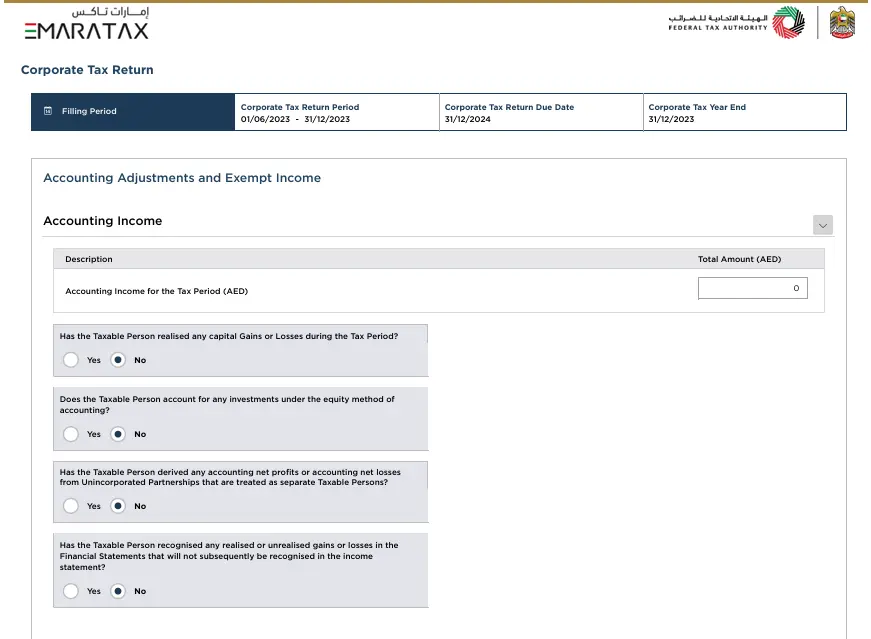

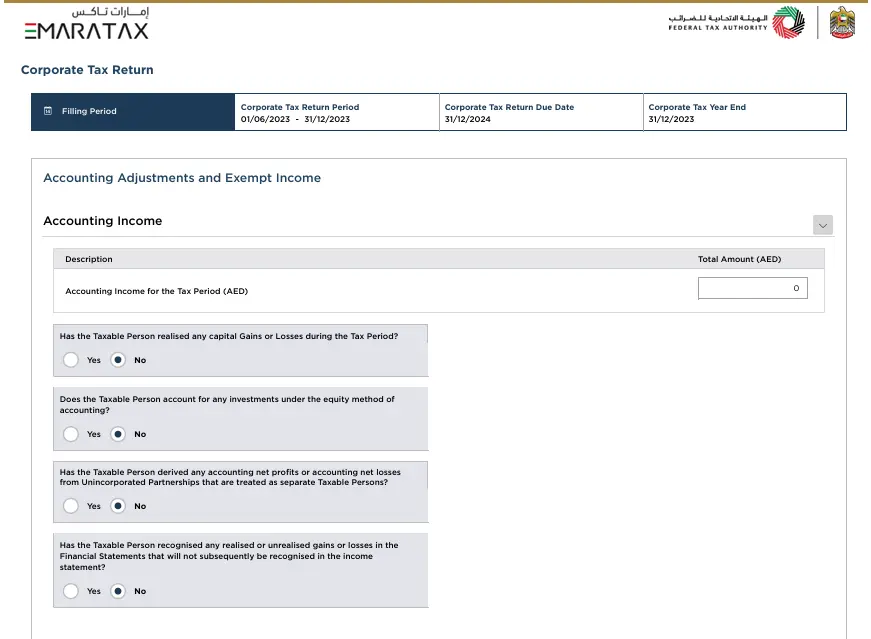

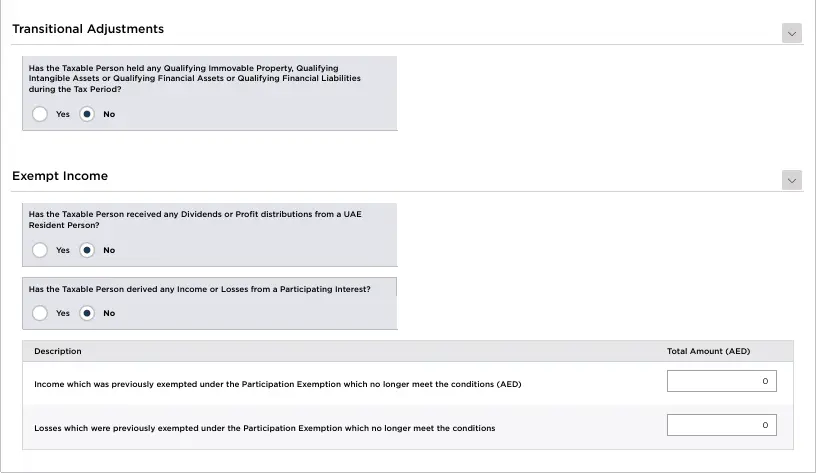

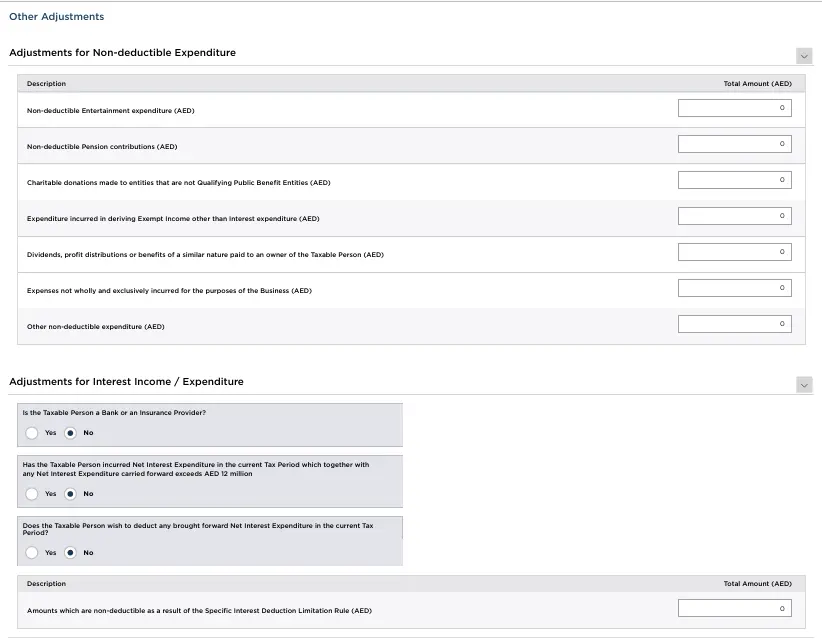

Accounting Adjustments

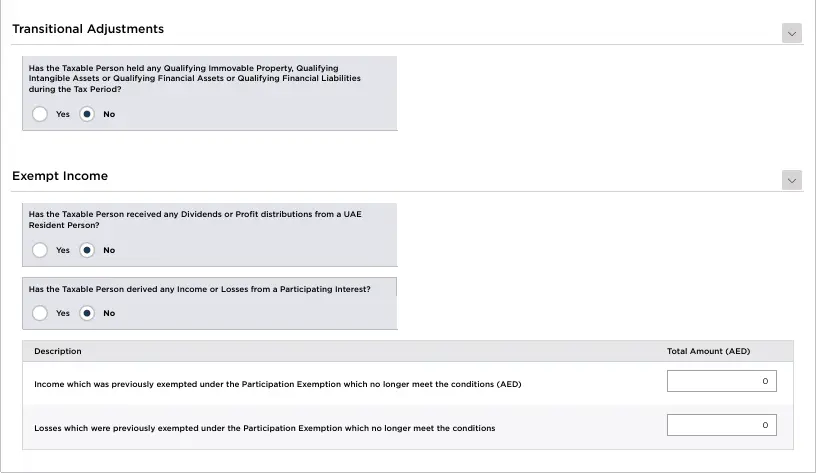

Transational Adjustments

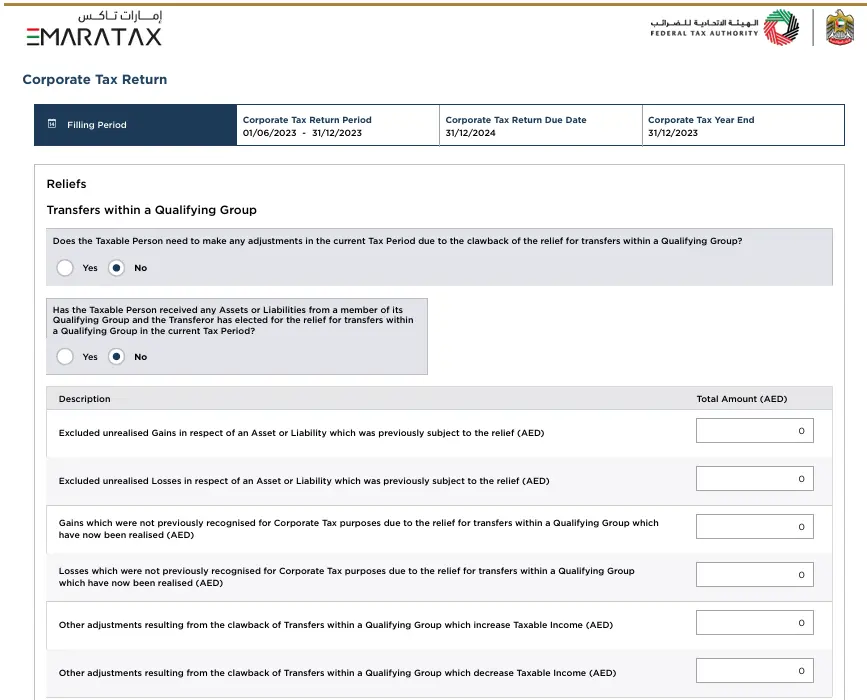

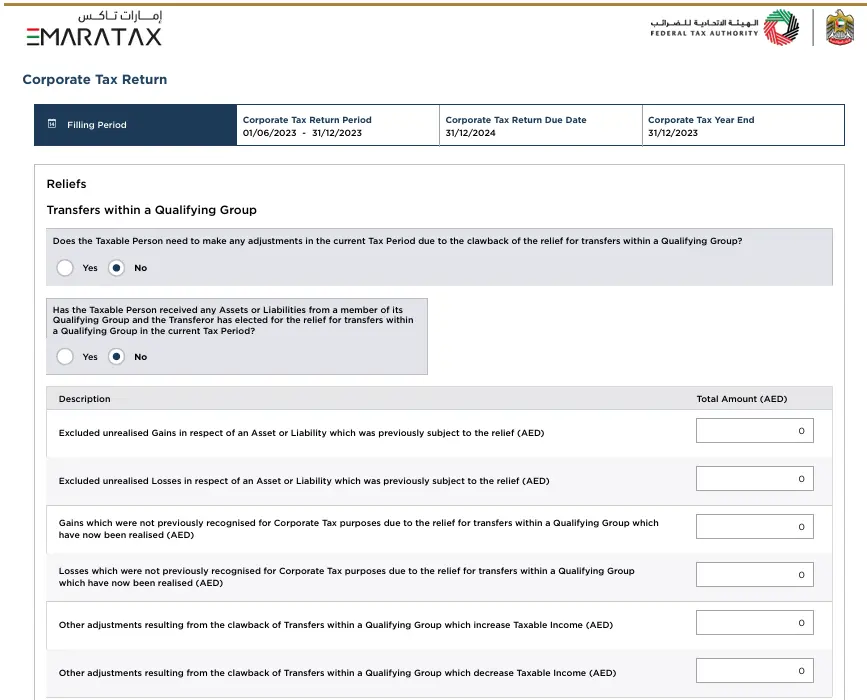

Reliefs

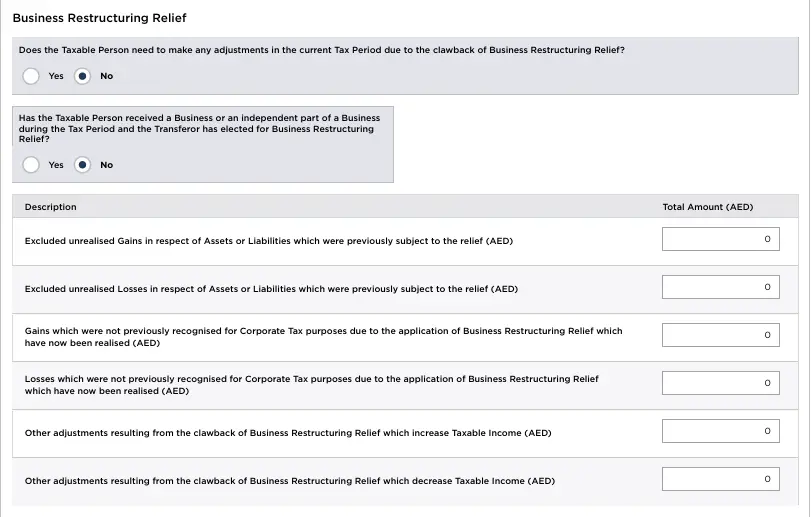

Business Restructuring Relief

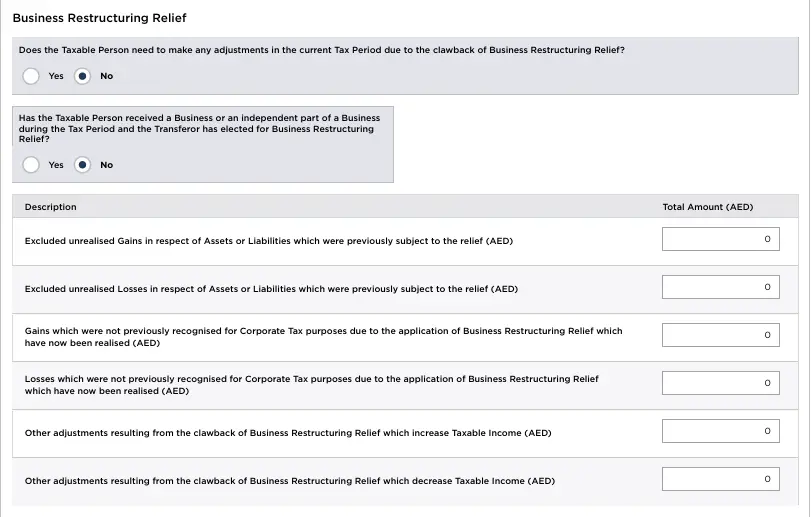

Adjustments

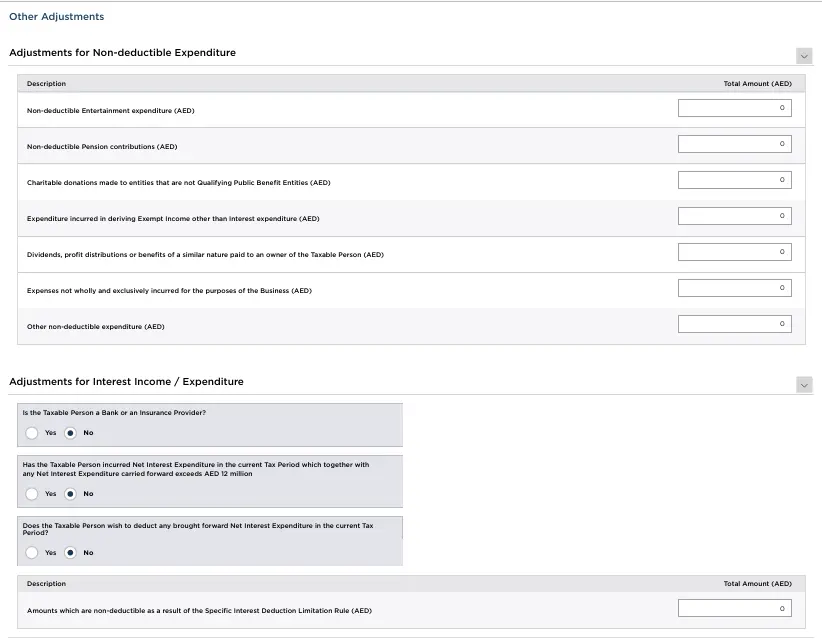

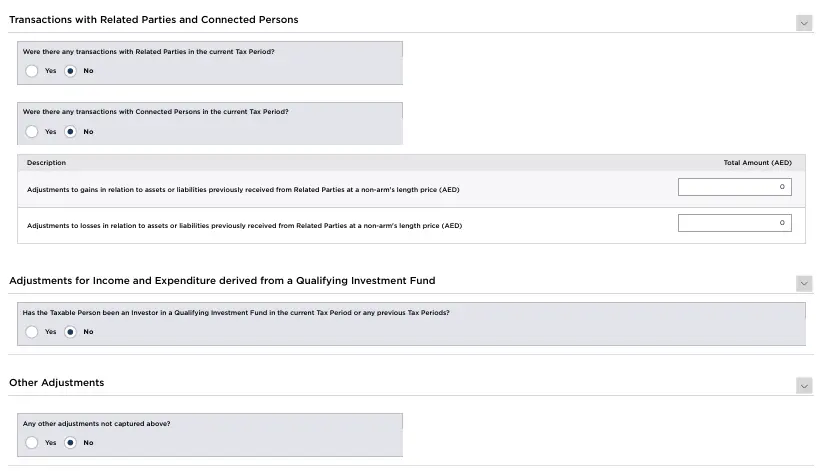

Transaction with Related Parties and Connected Persons

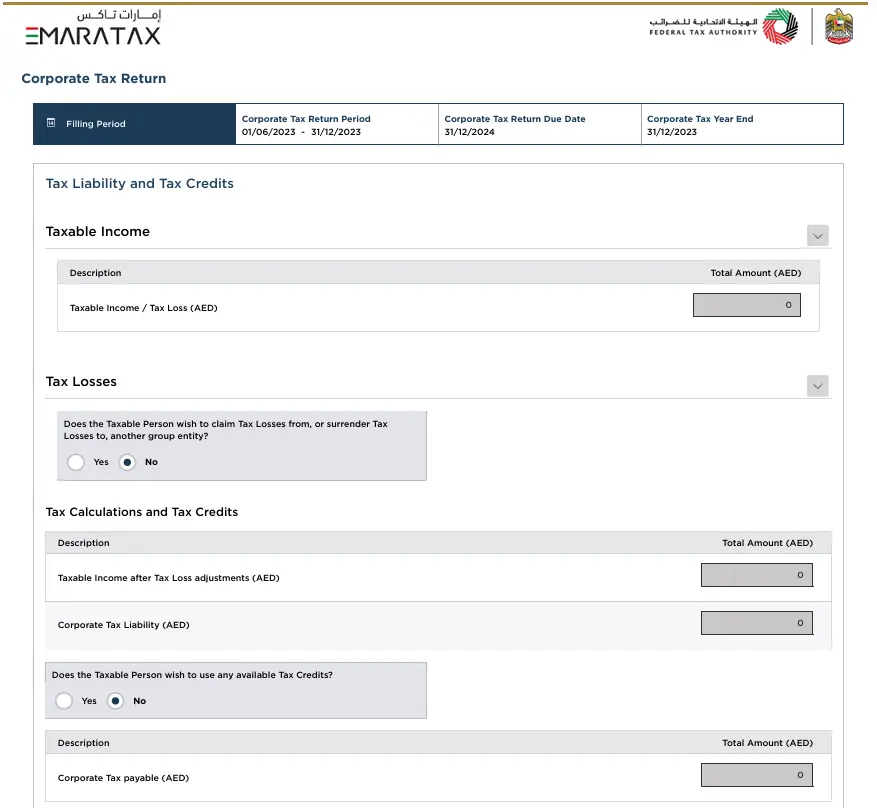

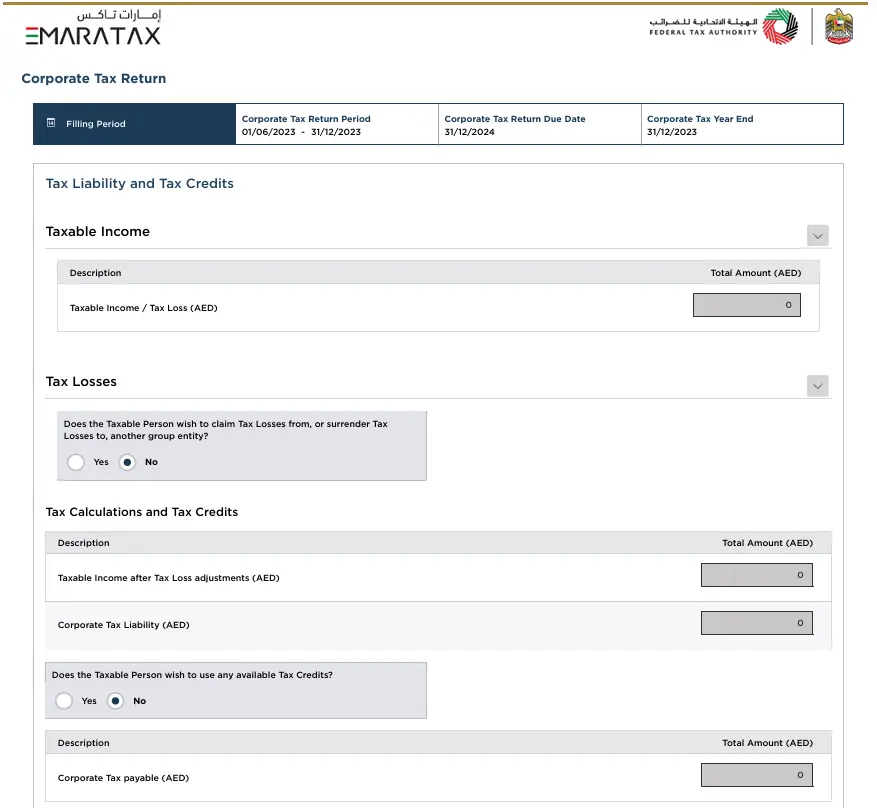

Tax Liability and Tax Credits

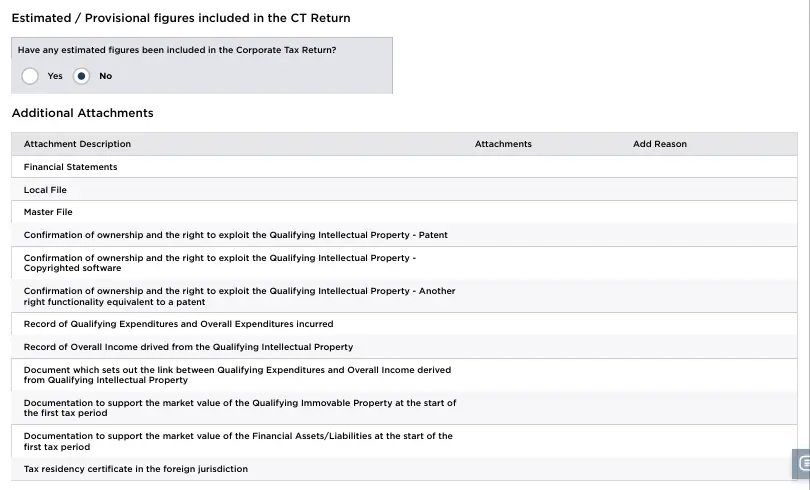

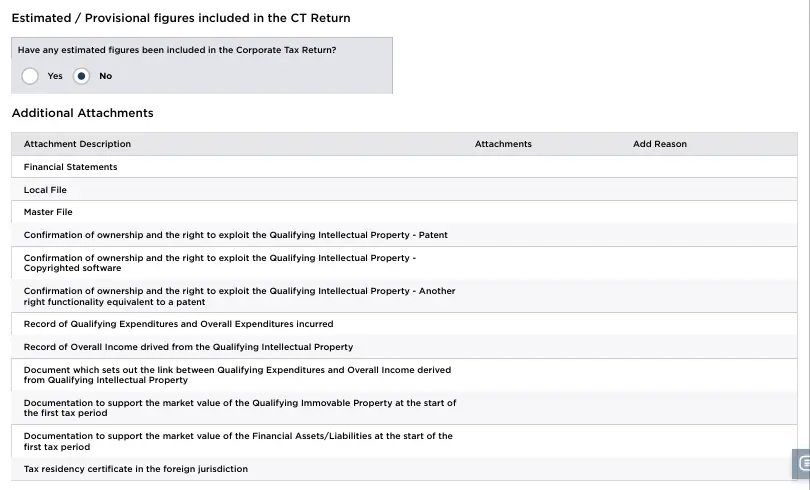

Estimated/Provisional Figures

For more information visit Corporate Tax Return filing Form filling

Corporate Tax Rates

The UAE's corporate tax rates are made to be fair and help the country's economic growth. They provide a clear and transparent system for all businesses in the UAE. Most businesses in the UAE will pay a standard corporate tax rate. This rate applies to many sectors and aims to create a level playing field for all companies.

In the UAE, both people and companies have to pay taxes based on how much money they are earning . If someone's income is AED 375,000 or less, they don't have to pay any taxes (that's the 0% rate). But if they are earning more than that, they have to pay a 9% tax on the extra money they earn above AED 375,000. Any income that does not meet the qualifying criteria is taxed at a rate of 9%, as specified in Cabinet Decision No. 55 of 2023.

Some industries, like oil and gas, have special tax rates. These rates are usually higher because these sectors make more money and are very important. The special rates reflect the unique impact and rules of these industries.The Federal Tax Authority (FTA) will manage corporate tax.

Corporate Tax Return Filing - Eligibility Criteria

To know if a business must pay corporate tax in the UAE, it needs to meet certain conditions. Following these conditions helps businesses follow UAE tax laws and support the country's economy.

- If a business or person has a license to do business in the UAE, they need to pay corporate tax.

- Businesses in free zones must also pay corporate tax. But if they follow all the rules and don't set up in the main areas, they might get some benefits.

- Companies and individuals from other countries doing regular business in the UAE must pay corporate tax.

- Certain types of businesses like banks, real estate companies, builders, and brokers have to pay corporate tax.

- Any business that regularly operates in the UAE needs to follow the rules for corporate tax.

Corporate Tax Filing - Required Documents

To pay corporate tax in the UAE, businesses must collect documents. These papers are important for showing how much money the business makes and spends. They also help follow tax rules.

- Balance Sheets showing the financial position of the business at a specific point in time.

- Profit and Loss Statements detailing the business's revenues, costs, and expenses during a specific period.

- Cash Flow Statements tracking the inflow and outflow of cash, showing how the business's cash position changes over time.

- A Tax Residency Certificate (TRC) proving that the business is a tax resident of the UAE, which affects tax rates and benefits.

- The Business License, which is the official license to operate in the UAE.

- Detailed Records of Financial Transactions, including sales, purchases, expenses, and investments.

- Statements of Incoming and Outgoing Funds related to business activities.

- Invoices and Receipts supporting records of sales, purchases, and expenses.

- Employee Records, including details of salaries, benefits, and taxes paid.

- Contracts and Agreements related to business activities, partnerships, or services provided.

- Previous Tax Returns filed by the business.

- Audit Reports, if the business has been audited.

- Statements of Financial Position used to determine taxable income.

- Receipts for Claimed Deductions as proof of deductions claimed on tax returns.

- Depreciation Records as proof of asset depreciation for tax purposes.

- Transfer Pricing Documentation related to transactions with related parties.

- Details of Transactions Involving Related Parties.

- Changes in Financial Reserves that affect the company's taxable income.

- Statements of Financial Position to calculate exempt income.

- Documentation of Exemption Status as proof of any tax exemptions.

- Business Loan Documents indicating interest paid.

- Records of Foreign Taxes Paid for foreign tax credits.

Here's a more detail overview on Corporate Tax Filing Documents.

Corporate Tax Return Filing - Procedure

- First, get a tax registration number from the Federal Tax Authority (FTA) by giving them the needed documents and info.

- Keep good records of all money transactions and tax papers as per UAE tax laws.

- Find out how much money is taxable and prepare a tax return using the records you kept. Consider any tax deductions or exemptions allowed by UAE tax laws.

- Send the tax return to the FTA using their online platform called e-Services. Do this before the due date.

- Pay the tax you owe based on the tax return before the due date.

- If the FTA checks your taxes (called a tax audit), they might ask for more info or papers to make sure your tax return is correct.

UAE Corporate Tax Return Filing Steps

Step 1: Taxpayer Information

Provide detailed information about the taxpayer, including:

- Entity name

- Tax Registration Number (TRN)

- Entity type and subtype

- Contact details and address

- Tax period details

Step 2: Election

Choose the applicable elections for the tax return, such as:

- Small Business Relief

- Realization basis

- Excluding Foreign Permanent Establishment Income

- Adjusting Taxable Income for gains on Qualifying Immovable Property or Intangible Assets

- Business Restructuring Relief

- Additional information or disclosures

Step 3: Schedule of Accounting

Fill in the financial details, including:

- Revenue and other income

- Various expenses (excluding specific categories like salaries, wages, depreciation)

- Earnings before Interest, Taxes, Depreciation, and Amortisation (EBITDA)

- Net profit or loss before tax

Step 4: Tax Computation

Calculate the income before and after adjustments, which involves:

- Accounting Income

- Adjustments for exempt income, reliefs, and non-deductible expenditures

- Adjustments for related party transactions and connected persons

- Determine the taxable income after all adjustments

Step 5: Additional Information involved

Provide any additional documents or information requested, such as:

- Proforma Invoice or other supporting documents

- Explanation for non-provision of any required document

Step 6: Declaration

Declare the accuracy and completeness of the information provided:

- Fill in the declarant’s name in both English and Arabic

- Submission date and time

- Generate and submit the document for official processing

These steps ensure that all necessary details and computations are accurately recorded for the UAE Corporate Tax Return filing process.

Corporate Tax Return Amendments and Corrections

A standard procedure for amending corporate tax returns entails following the standard procedure of the tax authority. Generally, the three steps that would allow a taxpayer to correct an error are as follows:

1. Locate the Mistake

The element of locating the mistake or omission in a tax return already filed essentially pertains to finding any error or omission that may be contained in the tax return. An example of errors would be any incorrect income, deductions, credits, or even some form of calculations. All financial statements or receipts must be accurate so that the amendment does not contain the same errors.

2. Gather the Forms and Supporting Documents Needed

Most tax administrations have special forms for amending a corporate tax return. In the United States, the IRS uses Form 1120-X to amend a corporate tax return. Other countries or states may have other or additional forms, so check the form needed by the taxing jurisdiction.

3. Complete the Amendment Form

On the amendment form, you will usually be required to:

- Report amounts as filed

- Show the corrected amounts.

- Calculate the difference and explain what corrective action is adopted.

Check that all figures are accurate. Include backup documents, such as altered financial statements, recalculated depreciation schedules, or recalculated tax schedules, as appropriate.

4. Explain Reasons for Change

Change forms for most amendments typically require an explanation of why the change is being made. Briefly state the nature of the error, how it was discovered, and why the correction must be done.

5. File Amended Return with the Taxing Authority

File the amended return with the taxing authority using the same methods as before: either electronically or by postal mail, depending on the instructions. In fact, the method of resubmission and the address to submit at may be different than before.

If your error results in additional tax due, make sure to pay that amount without delay to avoid both interest and penalties from compounding.

6. Track the Status and Maintain Records

Keep a copy of the amended return and any accompanying correspondence. Many tax authorities will permit some form of tracking status on an amendment. Amendments will likely take longer to process than the original returns, so you would want to adjust the timing of your refund or adjustment accordingly.

7. Consider Penalties and Interest

In cases where an amendment incurs additional tax liability, there may be penalties and interest for delayed payment. If this was an innocent error, you can file a penalty abatement to have it removed or reduced if you qualify.

8. Consult Tax Professional

Since amending corporate tax returns can prove to be rather complex when errors extend beyond one year, proper amending of those returns can become rather complicated. A professional tax practitioner could ensure that the correction is proper and no chance of unnecessary penalties or complications will arise from those mistakes.

Ensuring the correct filing of amended corporate tax returns and proper reflection of the financial activities of the corporation involved in following this process.

Corporate Tax Exemptions in UAE

Some entities and income types in the UAE are exempt from corporate tax. These include:

Basic Exemptions

- Small and Medium-Sized Businesses: Businesses with revenue up to AED 375,000.

- Free Zone Businesses: Multiple incentives and exemptions apply to Free Zones.

- Non-Mainland Businesses: Businesses not located on the mainland.

- Dividends and Capital Gains: Income from shareholdings is not taxed.

- Inter-group Transactions and Restructuring: Certain transactions within group companies are exempt.

Specific Exemptions

Government Entities:

- Exempt from Corporate Tax unless conducting business under a license.

- Licensed business activities must be treated as independent entities with separate financial statements.

Government-Affiliated Entities:

- Exempt unless engaging in non-mandated business activities, which must be treated independently.

Extractive Businesses:

- Exempt if holding a right or license from the local government and affected by specific Emirate regulations.

- Income from supportive activities should not exceed 5% of total revenue to maintain exemption.

Non-Extractive Natural Resource Businesses:

- Exempt if holding a right or license from the local government.

- Similar conditions as extractive businesses apply for income from supportive activities.

Qualifying Public Benefit Entities:

- Established for religious, charitable, scientific, artistic, educational, or similar purposes.

- Must follow with additional conditions set by the Cabinet.

Qualifying Investment Funds:

- Regulated by an appropriate authority.

- Interests are traded on a recognized stock exchange or made available to investors.

- Not intended to avoid Corporate Tax.

OECD and Base Erosion and Profit Shifting (BEPS)

The UAE corporate tax framework is significantly influenced by the very significant influence of the OECD's Base Erosion and Profit Shifting (BEPS) initiative, particularly in areas such as transparency, prevention of tax avoidance, and standardized reporting requirements. This article goes deeper into how BEPS affects UAE's corporate tax landscape:

1. Understanding BEPS and its objectives

- BEPS stands for tax planning techniques that intend to allow multinational businesses to shift profits away from high-tax jurisdictions into the low-or-no-tax geographies, usually by way of financial and legal structures so that the overall tax outlay is reduced. In response to counter strategies of this kind, the OECD launched the BEPS project to enhance equitable and more transparent international tax arrangements.

- The key objectives of BEPS are to close tax rule gaps that allow profit shifting, enhance greater transparency, and challenge other countries to apply consistent tax rules worldwide.

2. Impact of BEPS on UAE's Corporate Tax Framework

- Traditionally a low-tax jurisdiction, the UAE has aligned with some of the BEPS recommendations as an expression of commitment to international norms. These include the practice of international tax avoidance and anti-profit shifting. This process of transparency and standards for tax reporting is envisioned to enhance the business environment into a stable and competitive venture that stays within OECD's guidelines.

- The United Arab Emirates introduced its federal corporate tax regime, partly inspired by the principles of BEPS in 2023. This brings the UAE in line with global tax jurisdictions, making it a more transparent and controlled jurisdiction for multinational companies.

3. Key BEPS-Related Laws of the UAE

- Country-by-Country Reporting (CbCR): Because it is a BEPS action, the UAE requires MNEs with over a certain threshold amount of consolidated revenue to file CbCR reports. The reporting requirement binds such large groups to report the income, profit, taxes paid, and other financial data for every territory in which they are operating with the intention of increasing transparency and fewer pathways for shifting profits.

- Economic Substance Regulations (ESR): ESR was introduced in the UAE in order to have companies involved in kinds of income-generating activities of some specific types (like banking or insurance, intellectual properties) make actual economic activity in the country. The primary philosophy of ESR is to prevent incorporation in the UAE simply for tax advantages. ESR ensures that companies can prove and substantiate their operations and economic contributions.

- Transfer Pricing Regulations: Transfer pricing laws in the UAE, with guidelines from the OECD, help ensure that the transactions between associated entities are carried out at arm's length. The UAE by enforcing these standards discourages companies from inflating or reducing profits artificially in a certain jurisdiction for tax benefits.

4. More Transparency and Compliance Burden

- The BEPS action agenda involves requiring corporations to maintain comprehensive and correct reporting of their worldwide financial operations. The standards provided with regard to reporting offer more transparency, therefore, the tax administrations can scrutinize the multinational structures to ensure that no tax base is being eroded.

- Compliance under the BEPS will also enable UAE to become a compliant jurisdiction in the global business family without the risks of blacklisting by some other countries or economic entities.

5. Tax Strategy and Corporate Governance Adjustments

- The companies operating in the UAE are undergoing adjustments to their tax strategy and corporate governance arrangements in line with the BEPS recommendations. This entails updates in their internal policy to ensure all reporting is done accurately; transfer pricing documentation is complete; and compliance practices are strengthened.

- These practices would help them manage tax risks better and cultivate trust among the tax authorities and stakeholders worldwide.

6. Benefit to the Business Environment of UAE

- By complying with BEPS, the UAE remains an international financial center that takes responsibility for attracting global investors for being compliant and transparent jurisdiction. The UAE remains competitive with its BEPS compliance for multinational businesses while protecting against potential sanctions or reputational risks.

- Adherence of the UAE to the OECD guidelines forms trust within the tax structure, hence encouraging sustainable business practices leading to long-term economic stability.

Post-filing and Appeals Process

1. Accounting and Bookkeeping

-

Bookkeeping Data: In UAE companies, the tax records, invoices, receipts, bank statements, and other related data are to be kept for at least five years in total. This will cross-verifying figures reported and strengthens the authenticity of tax returns whenever audited.

-

Record System: Develop proper record systems, either digital or paper-based, store the data systematically so that it may be easily accessed if the FTA demands any data within them.

2. Reviews and Audits under FTA

- Audit Notification: FTA may selectively select to audit businesses on reviews if there is risk assessment or inconsistency on various filings. If a business is selected, then the scope and requirements for the audit will be elaborated in a formal notice.

- Audit Preparation: Organize records to be easily accessible and match the filed returns. Having an individual or a professional to assist with the response to inquiries from FTA can speed up the process and reduce errors.

- Conduct at audit: The FTA may request additional paper work or clarification on specific transactions while conducting an audit. Co-operation and transparency are very much sought after and can be of extreme worth because the decision of audits often makes future tax status and credibility.

3. Process of Dispute and Appeals

- Request for Reconsideration: If a business fails to agree with an FTA assessment or penalty, it may request reconsideration. This is subject to the requirement that it must be provided within 20 business days from the date of receipt of notice of assessment, with clear grounds for appeal and accompanying supporting documents.

- Tax Disputes Resolution Committee (TDRC): If the reconsideration process is not capable of resolving the problem for the business, then it may appeal to the TDRC. The TDRC allows an independent review of the case, which will be more time-consuming, but the business can plead its case fully.

- Federal Court: A business can take the legal issue to the UAE judicial system only as a last resort since business appeals are heard at the court following decisions of the TDRC. It is a formal process that requires legal support, and the consequences could be long-term.

4. Tax planning for future filings

- Review of Tax Position: By using deduction, credit, and transfer pricing, prudent tax planning can minimize liabilities and aids in compliance. It is of highest priority to get tax law updates within the UAE as well as outside the country to avoid sudden tax obligations.

- Tax Professionals: Tax accountants may help a business develop its strategy, fit well with FTA regulations, and keep the company away from some triggers that the auditor would audit.

- Improve the financial policies to make all the transactions well-documented, hence having fewer errors, easier subsequent submissions with the local authorities.

5. Fines or interest on delayed submission or payment

- Late Submission Penalties: FTA fines for tax returns submitted after the stipulated time. The charges depend on the period taken to submit and the tax amount assessed. This means the minimal penalties are only incurred when submission is timely.

- Interest on Late Payment: All the penalties and interest accruing on account of late payment are added to the total tax liability. Draft reminders and arrange for prepayment of taxes due.

- Penalty Relief: Businesses often have the chance of penalty relief or even complete waiver in some cases, on consideration of genuine reasons such as financial hardship or natural calamity. Well-prepared records and timely presentation before the FTA is the way for leniency in such circumstances.

6. Ongoing Compliance and Reporting

- Periodic Reporting: Most businesses have periodic VAT returns and other tax returns to file. Keeping a calendar of due dates for filings helps avoid lapses in compliance.

- Monitor Updates in Tax Legislation: The UAE tax legislation and FTA requirements keep changing. Continuous monitoring of updates in FTA and adjustment of the compliance practice will ensure continued observance of the requirements.

- Internal audits and Training: Internal audits combined with regular training provided to the staff ensure that such practices may be reinforced, and weaknesses are discovered so that each department of the organization may adequately be aligned with the tax obligations.

Corporate Tax Filing Deadline

Knowing when to file corporate tax in the UAE is important. Companies need to file their annual tax return within 9 months after their financial year ends. They also have to make estimated tax payments every three months, depending on their financial year. The final tax payment is due with the annual tax return, also within 9 months after the financial year ends. Sometimes, companies can ask for more time to file, but they need approval from the tax authorities. Missing these deadlines can lead to penalties, so it’s important to follow the schedules set by the UAE tax authorities.

To know more about Corporate Tax Filing Deadline, check out here.

Penalties for Non-Compliance

In the UAE, not following corporate tax rules can result in big penalties. According to Cabinet Decision No. 75 of 2023, if you don't keep required records, you could be fined AED 10,000 per violation, which can go up to AED 20,000 if you repeat the violation within 24 months. Not submitting required documents in Arabic can result in a AED 5,000 fine. Submitting a deregistration application late can lead to a AED 1,000 fine, plus an extra AED 1,000 each month, up to AED 10,000. If you don't inform the tax authority of changes to your tax records, you could be fined AED 1,000 per violation, or AED 5,000 for repeated violations within 24 months. Legal representatives who don't notify their appointment will face a AED 1,000 fine. Filing a tax return late will cost AED 500 per month for the first 12 months, then AED 1,000 per month after that. If you don't pay your taxes on time, there is a monthly penalty of 14% per year on the unpaid amount until the tax is paid. These penalties show how important it is to follow the tax rules on time and correctly in the UAE.

To know more about Corporate Tax Filing Penalties, check out here.

Benefits of Hiring Corporate Tax Filing Consultants in UAE

1. Expertise in UAE Tax Laws and Regulations

Corporate tax filing consultants in UAE possess in-depth knowledge of the country's tax laws and regulations, ensuring accurate and compliant tax filings.

2. Minimizing Errors and Penalties in Tax Filings

By hiring corporate tax filing consultants, businesses can minimize errors and penalties associated with tax filings, reducing the risk of financial losses and reputational damage.

3. Efficient Tax Planning to Optimize Liabilities

Corporate tax filing consultants can help businesses develop efficient tax planning strategies to optimize their tax liabilities, reducing the financial burden of taxation.

4. Assistance in Maintaining Compliance with Evolving Regulations

UAE tax laws and regulations are constantly evolving. Corporate tax filing consultants can assist businesses in maintaining compliance with these changes, ensuring that they remain up-to-date and compliant.

Key Services Offered by Corporate Tax Filing Consultants in UAE

Corporate tax filing consultants in UAE provide various essential services to help businesses comply with the new corporate tax regulations effectively. Here are the key services they offer:

1. Tax Registration and Filing Services

Consultants assist businesses in registering for corporate tax with the Federal Tax Authority (FTA) and ensure timely filing of tax returns. This includes preparing all necessary documentation and ensuring compliance with registration deadlines.

2. Advisory on Corporate Tax Regulations

Tax consultants offer expert advice on the latest corporate tax regulations, helping businesses understand their obligations and identify opportunities for tax savings. They keep clients informed about changes in legislation that may affect their tax position.

3. Reviewing and Verifying Tax Documentation

Consultants review financial records and documentation to ensure accuracy and completeness before submission. This process helps identify any discrepancies or issues that could lead to penalties or audits.

4. Preparation and Submission of Tax Returns

Corporate tax consultants prepare detailed tax returns based on the company's financial statements, ensuring that all income, deductions, and credits are accurately reported. They handle the submission process to ensure compliance with FTA requirements.

5. Handling Tax Audits and Inquiries

In the event of a tax audit or inquiry from the FTA, consultants represent businesses, providing support and guidance throughout the audit process. They help prepare responses to inquiries and ensure that all necessary information is provided.

Choosing the Right Tax Filing Consultant in UAE

When selecting a corporate tax filing consultant, businesses should consider several factors to ensure they choose a qualified partner:

Factors to Consider

- Experience: Look for consultants with a proven track record in corporate tax compliance and advisory services within the UAE.

- Reputation: Investigate client testimonials and evaluations to determine the consultant's credibility and efficacy..

- Knowledge of UAE Laws: Ensure that the consultant is well-versed in UAE corporate tax regulations and has experience dealing with local authorities.

Importance of Tailored Services for Industry-Specific Needs

Different industries may have unique tax considerations. Choosing a consultant who offers tailored services based on industry-specific needs can provide significant advantages in compliance and tax planning.

Value-Added Support Like Tax Training and Advisory

Some consultants offer additional services such as training sessions for staff on corporate tax matters, helping businesses stay updated on regulatory changes and best practices in tax compliance.

Corporate Tax Return Filing Services in UAE - Reyson Badger

Reyson Badger offers easy corporate tax return filing services in the UAE, ensuring your business follows all tax regulations accurately. Our services include preparing and filing your annual tax returns, managing quarterly estimated tax payments, and handling any extensions needed for filing. We also assist with maintaining proper records and documentation to avoid penalties. With our expert team,you can be sure that your corporate tax duties are taken care of on time, so you can focus on growing your business. Trust Reyson Badger for simple and stress-free tax return filing in the UAE