Since 2018, the United Arab Emirates (UAE) has indeed introduced Value Added Tax (VAT), which has diversified revenue flows into the economy and continues to enhance growth. VAT applies in Dubai at a rate of 5 percent on most goods and services, except on other items. VAT regulations should be familiar to a startup founder in Dubai so the business can be up-to-date with the utmost optimization of finances and in maintaining business progress. VAT registration is particularly important because it directly impacts the ability of a startup to exist, grow, and compete in the marketplace. Non-registration or failure to adhere to the registration brings penalties, fines, and reputational damage. Therefore, VAT registration is indeed one of the phases of Dubai startups which prevents violations, financial efficiency, and business success.

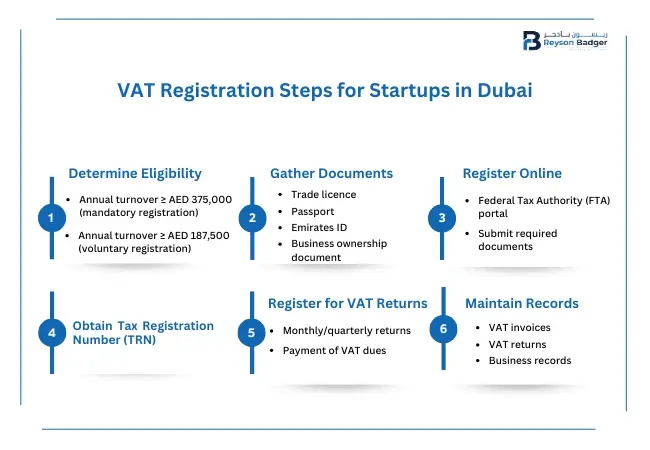

VAT registration requirements have become a norm, especially where jurisdictions like the UAE require certain thresholds and documentation for registration. Here's a comprehensive overview of VAT registration requirements relevant to startups.

What are Taxable Supplies?

Certain transactions are subject to VAT, as defined under taxable provisions. In startup cases, it comprises any sale levied by the business under the VAT regime. A company knows if its supplies are taxable and consequently, if it is obliged to register for VAT.

Registration Thresholds

Paperwork Required

To complete the VAT registration process, startups must ready several basic documents, namely:

The registration of new ventures is perhaps one of the critical compulsory steps that every startup needs to adhere to in Dubai, UAE.

1. Complete the Registration Form: From the dashboard, select VAT101 & Register for VAT. Fill out the required information, including:

2. Upload the necessary files: Get the required paperwork ready and submit it, including

To comply with the tax laws of the United Arab Emirates, startups conducting business operations must meet the following Value Added Tax obligations. A summary of these obligations is discussed below:

1. Imposing VAT on Taxable supplies

All taxable persons must charge VAT on all their activities, including all supplies of goods and services made in the UAE. The normal VAT rate is 5%, which must then be added to the sale price for all the taxable merchandise and services to be sold by the business.

2. Preparing and transmitting VAT-compliant invoices

These new businesses are required under VAT to provide value-added compliant invoices for every sale they make. These invoices should include:

The invoicing must be done correctly as this enables customers to recover input tax and legally comply with the FTA rules.

3. Filing VAT Returns (Monthly/Quarterly)

Startups are expected to make their VAT reports on either a monthly or quarterly basis depending on their sales. This includes:

4. Paying VAT Dues

Once the VAT returns are submitted, the startups proceed to fulfill any obligations due to the FTA in terms of VAT. Bills should be paid as early as possible to avoid being charged extra fees and interest.

Registering for VAT offers several advantages that can significantly benefit startups:

VAT allows registered businesses to recover VAT charged on acquisitions and expenses for operations, therefore decreasing costs. This is especially important for young companies with significant start-up costs to cover.

By registering for VAT, the start-up can establish credibility with consumers and suppliers as it indicates that the company conforms to the laws on taxation. It may help to strengthen the business relationships and enhance trust in the market between them.

Many government contracts require suppliers to be VAT-registered. By registering, startups can qualify for these opportunities, potentially leading to significant business growth.

With VAT registration, startups can establish a structured accounting system that simplifies financial management. This includes tracking sales, purchases, and tax obligations systematically, making it easier to prepare financial statements and comply with tax regulations.

Following VAT can quite be very challenging for startups, and mistakes mean huge financial penalties and severe compliance issues. Here are some common VAT mistakes that startup ventures should avoid:

Another common mistake that many startups commit is the failure to register for VAT in time. Companies must monitor their turnover and once they pass the threshold limit that applies in the UAE, at this moment AED 375,000, register immediately. Late registration can result in fines and loss of VAT recovery of costs incurred before the registration.

The third common error is a false submission of VAT returns. These often involve miscalculations in VAT due, sales reported wrongly, and failure to take into account exempt or zero-rated supplies. Startups should ensure that the accounting systems are robust, and they consider using accounting software or professional services that minimize errors in VAT filings.

Poor documentation will attract problems at the time of audit as well as a failure to support VAT claims. Start-ups are supposed to be able to produce all record entries on point-of-sale invoices and receipts, and documents related to imports and exports. Proper records help ensure not only compliance but also appropriate VAT reporting.

Non-compliance with VAT regulations shall occur where some of the regulations on invoicing, charging the correct rate of VAT, and filing of taxes and returns are not met as expected. Startups should conduct themselves in conflict with VAT laws and regulations that are in practice in the country in question.

The registration of new ventures is perhaps one of the critical compulsory steps that every startup needs to adhere to in Dubai, UAE. VAT registration ensures financial efficiency while promoting the prospects of business. An informed founder of a startup knows all VAT obligations and duties, so he can maneuver his way through the complicated tax system of the UAE without attracting any penalty charges and focus more on innovating. The VAT consultant guides according to the personal needs of their clients in the dynamic business climate of Dubai at Reyson Badger.

Do not let VAT complexity hold you back. Secure your startup's financial future with the expert VAT consulting services by Reyson Badger. Contact us today 0501130164 to Schedule a consultation now and discover how our VAT expertise can propel your startup's success.